The Basics of Loan Terms

Definition and Importance of Loan Terms

Loan terms are the specific conditions and details associated with a loan agreement, including the duration, repayment structure, interest rates, and any fees involved. Understanding these terms is critical for borrowers as they dictate how much it will cost over the life of the loan, thus directly impacting financial health. For those pondering how do loan terms affect the cost of credit?, grasping these elements is the first step in making informed financial decisions.

Common Types of Loan Terms

Loan terms can vary significantly based on the type of loan. Here are some common categories:

- Short-term Loans: Typically offer durations of one year or less, suitable for urgent needs.

- Medium-term Loans: These last from one to five years and might be used for significant purchases or consolidation.

- Long-term Loans: Duration is generally over five years, often seen in mortgages and large auto loans.

Factors Influencing Loan Terms

Several factors come into play when determining loan terms:

- Type of Loan: Different loans come with different structures and requirements.

- Credit Score: A higher score can often lead to more favorable terms.

- Income: Lenders assess a borrower’s income to evaluate repayment capability.

- Market Conditions: Economic factors, including inflation and interest rates, can influence loan terms.

Interest Rates and Loan Terms

How Loan Terms Impact Interest Rates

Interest rates are perhaps one of the most significant components of loan terms. Generally, longer loan terms can lead to higher interest rates because the lender faces increased risk over time. Conversely, short-term loans usually come with lower rates due to the reduced risk. Borrowers should always consider how the term length influences the overall interest they’ll pay over the life of the loan.

The Role of Credit Score

Your credit score serves as a crucial parameter in determining loan terms. A higher score typically results in lower interest rates, as lenders see you as a reduced risk. For those with lower credit scores, it’s crucial to work towards improving that score before seeking loans to secure better terms. Acting on strategies such as paying down debts and ensuring bills are paid promptly can help elevate your score.

Comparing Fixed vs. Variable Rates

Another aspect of loan terms involves choosing between fixed and variable interest rates:

- Fixed Rates: The interest remains constant over the loan term, providing predictable payments.

- Variable Rates: These can fluctuate based on market conditions, potentially offering lower initial rates but increased unpredictability.

While both options have their merits, understanding your personal financial situation will help you choose the right one for your needs.

The Cost of Credit Explained

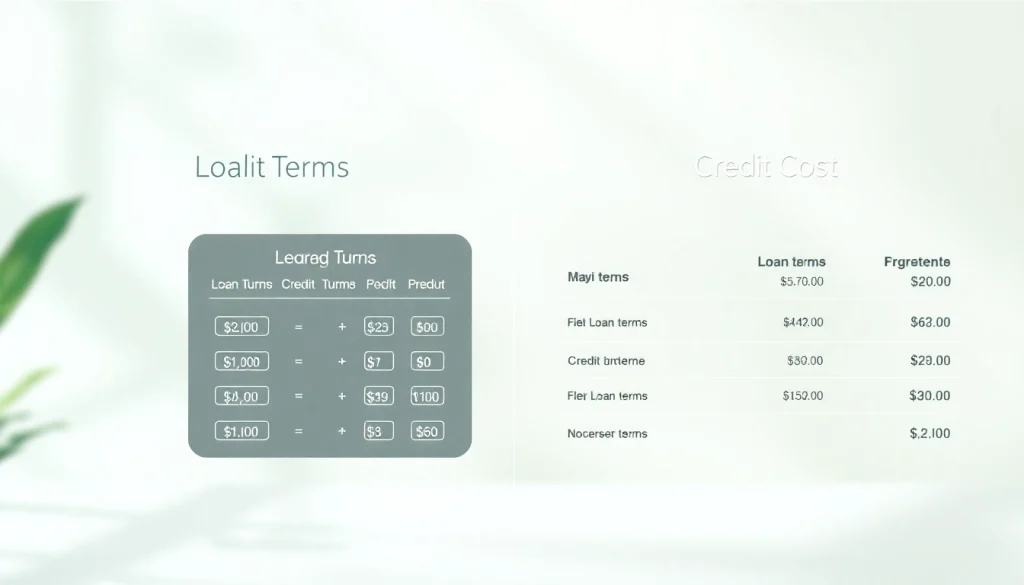

Calculating Total Cost Over Time

The total cost of credit involves not just the principal and interest but also any additional fees. Borrowers need to evaluate the loan’s total cost accurately over its lifespan. For example, a lower monthly payment can be appealing, but it might extend the loan duration, leading to increased interest payments overall.

Understanding APR and Loan Terms

Annual Percentage Rate (APR) is a crucial concept, as it includes not only the interest rate but also any fees or additional costs, providing a more comprehensive look at what borrowing will cost. High APRs can quickly lead to substantial financial burdens, making it essential to assess how loan terms affect this rate.

Hidden Fees and Charges

Always scrutinize loans for hidden fees that can inflate the perceived affordability. These might include origination fees, application fees, and late payment penalties. A straightforward loan may appear attractive initially, but such fees can severely impact overall expenses. Understanding these factors aids in evaluating the true cost of credit.

Strategies for Choosing the Right Loan Terms

Evaluating Your Financial Situation

Before diving into loan agreements, it’s critical to assess your financial landscape. Consider factors like your current debts, monthly income, and existing expenses. Understanding your budget influences your loan term choice. Make sure any loan term aligns with your financial capabilities to prevent future strain.

Essential Questions to Ask Lenders

When engaging with lenders, equip yourself with a list of questions to understand the nuances of your loan terms better. Important inquiries include:

- What is the total cost of this loan?

- Are there any hidden fees I should be aware of?

- Can the interest rate change over time?

- What are the penalties for late payment?

- Is there a prepayment penalty?

Using Loan Calculators Effectively

Utilizing online loan calculators can streamline your loan term choices. These tools allow you to input different terms, principal amounts, and interest rates to see potential monthly payments and overall costs. They enable valuable comparisons between loans to help you make informed decisions based on your financial goals.

FAQs about Loan Terms and Credit Costs

What is the average loan term length?

The average loan term length varies by type but typically spans between three to five years for personal loans, while mortgages may range from 15 to 30 years. Always consider your financial situation when selecting a term.

Can changing loan terms affect my monthly payment?

Yes, changing loan terms can significantly affect monthly payments. Extending the term usually lowers payments, while shortening it raises them. Aim for a balance that fits your budget without compromising your financial goals.

How do long-term loans compare in cost?

Long-term loans often appear more affordable in monthly payments; however, they generally incur more interest over time compared to short-term loans. Evaluate the total cost before choosing a long-term commitment.

What should I know about prepayment penalties?

Prepayment penalties are fees charged for paying off a loan early. Not all loans have this penalty, so it’s crucial to ask your lender. Being aware can impact whether you decide to pay off debt sooner.

How frequently do lenders adjust terms?

Lenders can adjust terms based on varying factors like interest rates or borrower qualifications. Regularly review your loan agreements and stay informed about any adjustments that may affect your financial obligations.